Most redemption programs suffer from the same challenge: delivering rewards that customers actually want. To make this possible, the programs offer ever-more rewards, which puts the onus on the customer to find desirable ways to spend their points. In the end, redeeming points can be more of a chore than a reward, ultimately diminishing the value of the very program that was supposed to create value and differentiation in a crowded space. But with millions of customers, no one (or even 100) reward(s) will meet the desires of everyone. So what are credit card issuers to do? How do they put the value back into these programs, so customers are incentivized to choose one card over another?

Most redemption programs suffer from the same challenge: delivering rewards that customers actually want. To make this possible, the programs offer ever-more rewards, which puts the onus on the customer to find desirable ways to spend their points. In the end, redeeming points can be more of a chore than a reward, ultimately diminishing the value of the very program that was supposed to create value and differentiation in a crowded space. But with millions of customers, no one (or even 100) reward(s) will meet the desires of everyone. So what are credit card issuers to do? How do they put the value back into these programs, so customers are incentivized to choose one card over another?

It’s a challenge of scale, but it is also a challenge of data. This is because travel history doesn't necessarily correlate to preferences. An executive who spends 75% on road (and uses his card heavily on business trips to keep track of expenses) doesn't necessarily love to travel. In fact, it's probably the last thing he wants to do in his spare time. So making assumptions about what he'll purchase based on his travel history is not the best method. Even if these card issuers had the means to measure customers’ transaction history and offer suitable redemption recommendations, upwards of 90% of consumers do not have a long or consistent enough history to draw meaningful inferences. So the new questions become, “How do companies identify which redemption offers to give to members with limited spend information? How do they identify customers who are truly passionate about a spend category? And how can they group members with similar spend affinities, regardless of the spend information available, to optimize redemption recommendations and ultimately increase spend?”

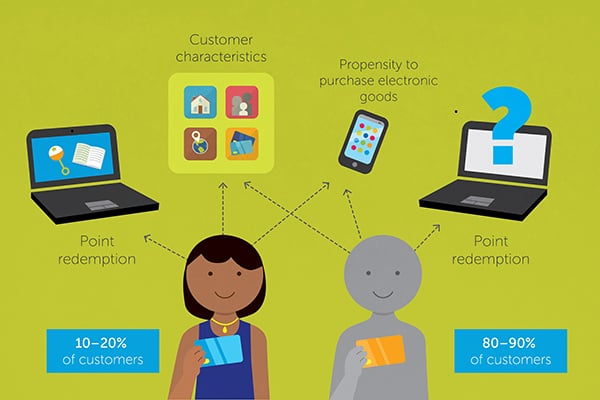

Answer: Change the problem from one about a lack of spend data to one about a surplus of behavioral and demographic data. The whole process is an analytic technique called look-alike modeling. Very simply, analysts study the 10–20% of the population for which they have rich transaction histories and can directly measure purchasing preference, and then determine what behavioral and demographic characteristics are significant about this group. (To control for wealth and other biases, customers are grouped into cohorts based on similar spend signatures). These characteristics, including marital status, house ownership, number of credit cards, and combinations thereof, are drawn from several widely available databases containing financial, demographic, and behavioral information, and they allow the analyst to predict the purchasing preferences for the remaining 80–90% of the population. These scores are generated from predictive models and allow the bank to generate customer-level marketing campaigns to optimize the offers customers receive. If they can avoid the pain of sifting through online redemption Websites and junk mail and instead are treated to a personalized experience, they will likely continue to use the card to cash in on even better deals the next time.

While personalized purchasing preferences for 100% of the customer population sounds pretty good, there's still room for improvement in the form of accuracy. For example, companies can improve the customer experience by conducting the same look-alike modeling process at a spend category level (travel, department stores, restaurants, etc.), which would mean each of the millions of customers would generate 30–40 scores that card issuers can rank order from highest to lowest preference. They could also apply the same look-alike modeling techniques to the 10–20% of consumers who visit the redemption Website regularly (to predict underlying purchasing preferences across the population) or the 10–20% of consumers who redeem the most often (to predict redemption behavior characteristics across the population). Taken together, the purchasing preference scores, online preference scores, and redemption preference scores — across all spend categories — can provide a holistic view of the customer that significantly enhances offer design and creates lucrative cross-selling opportunities.

Say there's a customer who travels a lot for work and uses his credit card to collect his redemption points. His card issuer can see that he travels a lot and consequently sends him redemption offers related to the places he visits. The issue is that he travels for work, leaving him little time to enjoy such offers. And of course, there’s more to him than just his job, but because he doesn’t spend much time on the redemption Website or redeem often, the card issuer has very limited data on his hobbies, preferences, or affinities.

That’s where Big Data intelligence comes in. Using advanced data science, companies can learn to apply what they’ve learned about people who do spend time online and redeem often to those who offer limited opportunities to collect meaningful data. So for instance, even though all the card issuer could tell about the example customer above was that he traveled a lot and used his credit card to collect redemption points but rarely redeemed them, they can fill in the details about his predicted purchase, redemption, and online preferences across all categories based on data-rich members of the population that look like the customer in question.

The models can, for example, uncover underlying preferences for electronic goods and a redemption affinity for baby products and books. Armed with this knowledge, the credit card issuer can design a redemption offer that caters to his predicted preferences and can even substitute more cost-effective promotions for categories that have a very similar predicted score. So for instance, if the customer has the same predicted preference for baby products as he does for books, the model will recommend sending the books offer if baby products are more expensive to the financial institution.

Do personalized offers really make that much of a difference? Can customer scores generate supercharged marketing performance? Absolutely. We’ve seen a 10X improvement in spend lift for campaigns aligned with purchasing preference compared with campaigns without this intelligence, increasing spend by more than $1 billion per year for large card issuers.

Top airlines, telecommunications companies, and financial institutions rely on this science and technology, which we call a Signal Hub, to help them serve customers better, reduce costs, and make the promise of Big Data more accessible throughout their organizations.

Opera Solutions’ Signal Hub has been essential in industrializing data science across a number of industries. It delivers ongoing, customer-level intelligence across entire ecosystems of customer accounts, facilitating automated scoring that seamlessly unveils hidden intelligence and links it to execution efforts, driving dollars directly to the bottom line. To learn more about how Opera Solutions’ Signal Hub can transform enterprise marketing operations, download our white paper “Intelligence Technology.”

Chris Bazett is a senior solutions associate at Opera Solutions, with a Master’s of Engineering Management degree from Duke University and a Bachelor's of Applied Science degree from the University of British Columbia. He has experience in the financial services, tech start-up, and engineering consulting industries on the west and east coasts of Canada and the United States.